I've only been through a couple of earnings announcement seasons, now, but it seems like an exciting time. Like Piotroski said, something like 1/6 of a stock's movement comes over the combined four days of the year that the company annouces earnings.

DECK kicked butt, reporting $0.83 per share, up from $0.63 compared to the same quarter last year. This blew away analyst estimates of $0.54, and the stock price jumped ~ 8%.

ISNS stunk it up. BLD was flat with last year. ALDN beat estimates by $0.03, and stayed pretty much flat, also.

SCSS came ahead of analysts estimates, but said that sales slowed towards the end of the quarter and so the stock price slid 17%.

Income nearly tripled for ATHR with 74% increased sales.

ARNA lost $20M on R&D, and stayed high, still for no real reason. It seems to have settled at ~$15, and as long as it stays around here, I'm happy.

Merck bought Sirna at a huge 100% premium. This sent ALNY up ~20%, as pretty much the only independant microRNA company left. Pretty sweet.

DECK kicked butt, reporting $0.83 per share, up from $0.63 compared to the same quarter last year. This blew away analyst estimates of $0.54, and the stock price jumped ~ 8%.

ISNS stunk it up. BLD was flat with last year. ALDN beat estimates by $0.03, and stayed pretty much flat, also.

SCSS came ahead of analysts estimates, but said that sales slowed towards the end of the quarter and so the stock price slid 17%.

Income nearly tripled for ATHR with 74% increased sales.

ARNA lost $20M on R&D, and stayed high, still for no real reason. It seems to have settled at ~$15, and as long as it stays around here, I'm happy.

Merck bought Sirna at a huge 100% premium. This sent ALNY up ~20%, as pretty much the only independant microRNA company left. Pretty sweet.

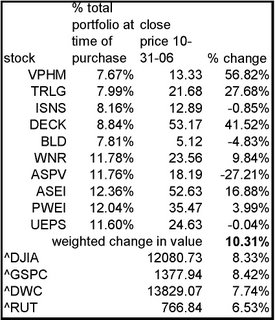

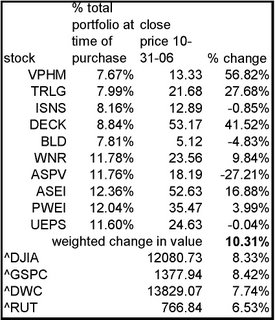

That leaves one company, which I'll save for the end of the post. My three portfolios are up. That's a pretty big thrill for a beginner like me. The biotech portfolio is not doing as well as the biotech indices, even after ALNY's boom. I still have some faith in CBST, but it is wavering a little. Basically, as it begins to show consistent profit in the next few quarters, I'd like to think that the share price will go up. However, as I'm starting to figure out, part of that expectation is already priced in, so CBST has to perform particularly well. That is the source of the wavering faith in it. NOVC seems to have some on-deck drugs in late-phase trials. Assuming those go moderately well, it'll spike. I'm pretty happy with both my MFI and HG portfolios. These are beating the market, and kicking butt compared to the Russell 2K. There has been discussion on the MFI board as to whether the system relies on a few really big winners, or whether most stocks move towards large gains. My results so far have 3 winners above 20%, 2 more 9% or greater, several that are within 5% of even, and one big loser. This is only after 4 months, which means that this is statistically meaningless, and also that anything can still happen. Finally, half of my most recent six HG picks are in the teens of returns, and half of my first set of picks are absolutely kicking butt. WLT is at 6%, and the others are nearly flat. Pretty darn good for the first four months.

There is one major caveat that I need to keep in mind. Of everything that I bought, I was really excited about ASPV. And that has proven to be the biggest loser so far. So I'm not a good stock picker: I'm lucky. From everything I've read, the longer I can keep that in mind, the better I'll do in the long run. So from now on, every time that I pick any basket of stocks, I'm going to predict which ones will do the best. I expect that these rankings will not at all correlate with actual performance, but will instead serve to keep me humble.

Finally, I want to talk about ASPV. This one is a whopper. First, it announced that it would miss analyst estimates for the quarter. It reiterated that for the year it would make 163% of last year's earnings. But still, it dropped 10%. I thought that was way less bad than the market thought. And then they announced that their drug didn't pass phase III trials for another indication, and the stock dropped another 11%. At this new price, the PE is ~6.5 TTM, with a forward PE of ~5.3. All of this together got me thinking. The CellCept patent runs out in 2009. So shareholders can count on about 2-3 more years of great earnings, and then the well dries up. Unless, that is, the company finds either another drug or another indication for their drug. It's a bit of a desperation situation. Another way of looking at this is: the PE is the number of years it takes for the current earnings per share to pay back the investment. From this perspective, investors at this point are betting 2.3 years worth of earnings that the company will find some way to remain profitable beyond the patent protection of CellCept. If they do find some way to remain profitable, the PE should shoot up to some amount beyond the patent protection or other limit of the new drug in question. The years worth of betting on management amount to 43% of the PE. Cash per share, after subtracting the miniscule amount of debt, is $5.50. So of the remaining cost of the share, is 43%, or ~$5.60, represents the bet that management will find a new drug, or a new indication for their drug, within the next few years.

to remain profitable beyond the patent protection of CellCept. If they do find some way to remain profitable, the PE should shoot up to some amount beyond the patent protection or other limit of the new drug in question. The years worth of betting on management amount to 43% of the PE. Cash per share, after subtracting the miniscule amount of debt, is $5.50. So of the remaining cost of the share, is 43%, or ~$5.60, represents the bet that management will find a new drug, or a new indication for their drug, within the next few years.

Finally, I want to talk about ASPV. This one is a whopper. First, it announced that it would miss analyst estimates for the quarter. It reiterated that for the year it would make 163% of last year's earnings. But still, it dropped 10%. I thought that was way less bad than the market thought. And then they announced that their drug didn't pass phase III trials for another indication, and the stock dropped another 11%. At this new price, the PE is ~6.5 TTM, with a forward PE of ~5.3. All of this together got me thinking. The CellCept patent runs out in 2009. So shareholders can count on about 2-3 more years of great earnings, and then the well dries up. Unless, that is, the company finds either another drug or another indication for their drug. It's a bit of a desperation situation. Another way of looking at this is: the PE is the number of years it takes for the current earnings per share to pay back the investment. From this perspective, investors at this point are betting 2.3 years worth of earnings that the company will find some way

to remain profitable beyond the patent protection of CellCept. If they do find some way to remain profitable, the PE should shoot up to some amount beyond the patent protection or other limit of the new drug in question. The years worth of betting on management amount to 43% of the PE. Cash per share, after subtracting the miniscule amount of debt, is $5.50. So of the remaining cost of the share, is 43%, or ~$5.60, represents the bet that management will find a new drug, or a new indication for their drug, within the next few years.

to remain profitable beyond the patent protection of CellCept. If they do find some way to remain profitable, the PE should shoot up to some amount beyond the patent protection or other limit of the new drug in question. The years worth of betting on management amount to 43% of the PE. Cash per share, after subtracting the miniscule amount of debt, is $5.50. So of the remaining cost of the share, is 43%, or ~$5.60, represents the bet that management will find a new drug, or a new indication for their drug, within the next few years.