My newest Hidden Gems are OYOG, SCSS, MIDD and NATH. Each of these have specific reasons for being bought, but unlike past buys, they didn't really have much to do with the company itself after my own research. The point of HGs is that they are supposed to be promising companies as determined by the pros over at Motley Fool. Nevertheless, as JG says, never trust anyone over 30, and never trust anyone under 30, either.  But still, the reasons for these purchases might be a little weak if I didn't have some trust in HG picks. Here they are: OYOG is only slightly above the recommended buy price from a few months ago. SCSS and MIDD are two of the three strongest recommendations that HG'ers have made. They keep on re-recommending them, and also they are on the HG list of best places for new money. This isn't what convinced me, though. It was that they have high Piotroski F-Scores. Finally, NATH is a Tiny Gem (below the official HG radar, like ALDN), but it is on the current list of MFI picks and has 16% ownership by insiders.

But still, the reasons for these purchases might be a little weak if I didn't have some trust in HG picks. Here they are: OYOG is only slightly above the recommended buy price from a few months ago. SCSS and MIDD are two of the three strongest recommendations that HG'ers have made. They keep on re-recommending them, and also they are on the HG list of best places for new money. This isn't what convinced me, though. It was that they have high Piotroski F-Scores. Finally, NATH is a Tiny Gem (below the official HG radar, like ALDN), but it is on the current list of MFI picks and has 16% ownership by insiders.

But still, the reasons for these purchases might be a little weak if I didn't have some trust in HG picks. Here they are: OYOG is only slightly above the recommended buy price from a few months ago. SCSS and MIDD are two of the three strongest recommendations that HG'ers have made. They keep on re-recommending them, and also they are on the HG list of best places for new money. This isn't what convinced me, though. It was that they have high Piotroski F-Scores. Finally, NATH is a Tiny Gem (below the official HG radar, like ALDN), but it is on the current list of MFI picks and has 16% ownership by insiders.

But still, the reasons for these purchases might be a little weak if I didn't have some trust in HG picks. Here they are: OYOG is only slightly above the recommended buy price from a few months ago. SCSS and MIDD are two of the three strongest recommendations that HG'ers have made. They keep on re-recommending them, and also they are on the HG list of best places for new money. This isn't what convinced me, though. It was that they have high Piotroski F-Scores. Finally, NATH is a Tiny Gem (below the official HG radar, like ALDN), but it is on the current list of MFI picks and has 16% ownership by insiders.While we're on the topic, here are the updates of my three portfolios. MFI is trouncing the indices. Even the new purchases are kicking in, with a great week for ASEI, up 10% in my first week of ownership, after it got a big contract from the Department of Homeland Security. DECK also had a great week, pushing past the 52-week high for ~5% gain. Finally, ISNS is recovering from its slump: from -12%, it is now only -4%.

Finally, ISNS is recovering from its slump: from -12%, it is now only -4%.

Finally, ISNS is recovering from its slump: from -12%, it is now only -4%.

Finally, ISNS is recovering from its slump: from -12%, it is now only -4%.For HG, IIVI and ALDN are doing great, CTRP is flutuating wildly, and SDA is recovering from its initial loss. The new purchases haven't had time to do anything yet, other than dilute my apparent gains (the initial set is up 12.3%!).

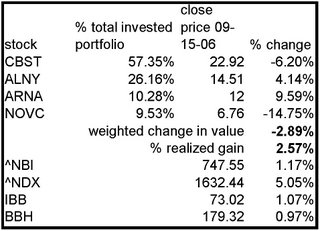

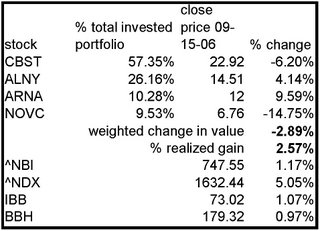

The Biotech portfolio is doing nothing special, down 3%. ALNY and ARNA are up, and ARNA is doing especially well, although these are both on no news. NOVC has recovered slightly, and CBST went up to nearly even, and has now fallen slightly again.

Finally, over Thursday and Friday, it was announced that the shareholders of LPMA and PAY had all voted to go through with the acquisition. I was a little surprised that the share price didn't go up on Thursday after LPMA made their announcement, and very surprised that after-hours trading of LPMA on Friday, after the announcement by PAY, didn't shoot the stock up, either. But we'll see - on Monday I'll be shocked if it isn't trading higher.

No comments:

Post a Comment