I've lately become interested in investing in the stock market. I started several years ago investing in index funds. I wasn't interested at the time in getting exceptional returns - just getting returns and not having to think about it. Well, I put my money into an index fund at the top of the bubble, watched my index fund lose 1/3 of its value, and actually found a way to make this seem positive. (I was able to take advantage of dollar-cost averaging! What a coup!) Well, now I want to actually do something with my savings. So I've started to do a little reading.

My initial reading, years ago, was a book called Get a Financial Life. Next was Suze Orman's The Nine Steps to Financial Freedom, which was basically the same basic message as the first book. The investing that I had been doing was right in line with what was suggested by these books. I'm not sure what changed, exactly, but more recently, I became interested in reading about stock investing. I happened to hear about a book called The Little Book That Beats the Market. It came with a Magic Formula for ~30% returns (known as MFI, for Magic Formula Investing), and backtesting showed that the formula worked.

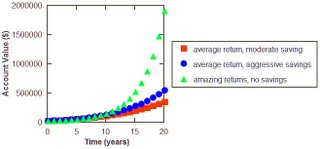

I read quite a while back about the magic of compounding. But yesteday and today, I played around with some numbers and was surprised to see how  amazing it really can be. It seems pretty common to assume a $10K starting investment, so I've done that here. "Average returns" is the (more or less) 11% historical return of the market. "Modest savings" is $4K per year, the amount to max out a Roth IRA. The maximum investment in a Roth is bound to go up, but I left it at $4K for the entire time of the series. "Aggressive savings" assumes that the amount saved will go up every few years - to $6K in 3 years, to $8K in 6 years, and so on. "Amazing returns" is the 30% suggested by MFI.

amazing it really can be. It seems pretty common to assume a $10K starting investment, so I've done that here. "Average returns" is the (more or less) 11% historical return of the market. "Modest savings" is $4K per year, the amount to max out a Roth IRA. The maximum investment in a Roth is bound to go up, but I left it at $4K for the entire time of the series. "Aggressive savings" assumes that the amount saved will go up every few years - to $6K in 3 years, to $8K in 6 years, and so on. "Amazing returns" is the 30% suggested by MFI.

amazing it really can be. It seems pretty common to assume a $10K starting investment, so I've done that here. "Average returns" is the (more or less) 11% historical return of the market. "Modest savings" is $4K per year, the amount to max out a Roth IRA. The maximum investment in a Roth is bound to go up, but I left it at $4K for the entire time of the series. "Aggressive savings" assumes that the amount saved will go up every few years - to $6K in 3 years, to $8K in 6 years, and so on. "Amazing returns" is the 30% suggested by MFI.

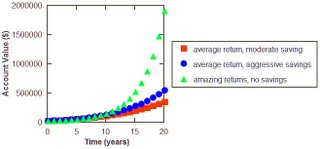

amazing it really can be. It seems pretty common to assume a $10K starting investment, so I've done that here. "Average returns" is the (more or less) 11% historical return of the market. "Modest savings" is $4K per year, the amount to max out a Roth IRA. The maximum investment in a Roth is bound to go up, but I left it at $4K for the entire time of the series. "Aggressive savings" assumes that the amount saved will go up every few years - to $6K in 3 years, to $8K in 6 years, and so on. "Amazing returns" is the 30% suggested by MFI.For the fir st few years, saving helps a lot. But within ten years, MFI beats the more moderate returns. Here's a zoom on the first twelve years. (I added in a data set for amazing returns with moderate saving, because that is realistic - and in this case, average returns, even with aggressive savings, never wins.)

st few years, saving helps a lot. But within ten years, MFI beats the more moderate returns. Here's a zoom on the first twelve years. (I added in a data set for amazing returns with moderate saving, because that is realistic - and in this case, average returns, even with aggressive savings, never wins.)

st few years, saving helps a lot. But within ten years, MFI beats the more moderate returns. Here's a zoom on the first twelve years. (I added in a data set for amazing returns with moderate saving, because that is realistic - and in this case, average returns, even with aggressive savings, never wins.)

st few years, saving helps a lot. But within ten years, MFI beats the more moderate returns. Here's a zoom on the first twelve years. (I added in a data set for amazing returns with moderate saving, because that is realistic - and in this case, average returns, even with aggressive savings, never wins.)Another way to look at this is: how long until this hypothetical $10K has been turned into $1M? The difference in time scale is surprising. This was the data that made something very clear to me: The classic Suze Orman example of how to save an extra few bucks for retirement is to not drink coffee every day. That $4 at Starbucks really adds up! Well, I don't even drink coffee. As far as I'm concerned, I've saved a huge amount given that I've only ever been a graduate student and a post-doc. And if I listened to Suze, I'd never save enough to have even $1M at this rate - and my expenses are only going to rise.

This was the data that made something very clear to me: The classic Suze Orman example of how to save an extra few bucks for retirement is to not drink coffee every day. That $4 at Starbucks really adds up! Well, I don't even drink coffee. As far as I'm concerned, I've saved a huge amount given that I've only ever been a graduate student and a post-doc. And if I listened to Suze, I'd never save enough to have even $1M at this rate - and my expenses are only going to rise.

This was the data that made something very clear to me: The classic Suze Orman example of how to save an extra few bucks for retirement is to not drink coffee every day. That $4 at Starbucks really adds up! Well, I don't even drink coffee. As far as I'm concerned, I've saved a huge amount given that I've only ever been a graduate student and a post-doc. And if I listened to Suze, I'd never save enough to have even $1M at this rate - and my expenses are only going to rise.

This was the data that made something very clear to me: The classic Suze Orman example of how to save an extra few bucks for retirement is to not drink coffee every day. That $4 at Starbucks really adds up! Well, I don't even drink coffee. As far as I'm concerned, I've saved a huge amount given that I've only ever been a graduate student and a post-doc. And if I listened to Suze, I'd never save enough to have even $1M at this rate - and my expenses are only going to rise.There was a bit of a bait and switch there - when I complaind that my expenses will only rise. My salary will as well. But this small analysis tells me that the question is not how to save more - even a lot more, like after my salary makes a major jump when I get a real job. The question is how to get exceptional returns. That is what this blog will be about.

1 comment:

Personally I think Greenblatt’s screen is a fine START. I believe it’s important to do further research. The results this year of the random selections are not that exiting. I believe this will continue in the coming years. This because of the –unexpected- rise in commodity prices over the last years.

By this many commodity companies have high returns on invested capital and high earnings yield, which make them to appear on the Greenblatt-screening, although they lack durable competitive advantages.

Success in investing,

Hendrik Oude Nijhuis

www.magicformulastocks.com

Post a Comment